When multiple styles of algorithmic trade flows directionally align with discretionary trade flows in a nearly-synchronized manner across asset classes it can create feedback loops that exaggerate the velocity and magnitude of price path deviations across a wide array of markets.

Feedback loops ripple through flat prices, time spreads, relative value spreads and implied volatility levels.

The effects are typically most pronounced during risk-off events, such as that witnessed in March, and risk-on events, such as that witnessed last week.

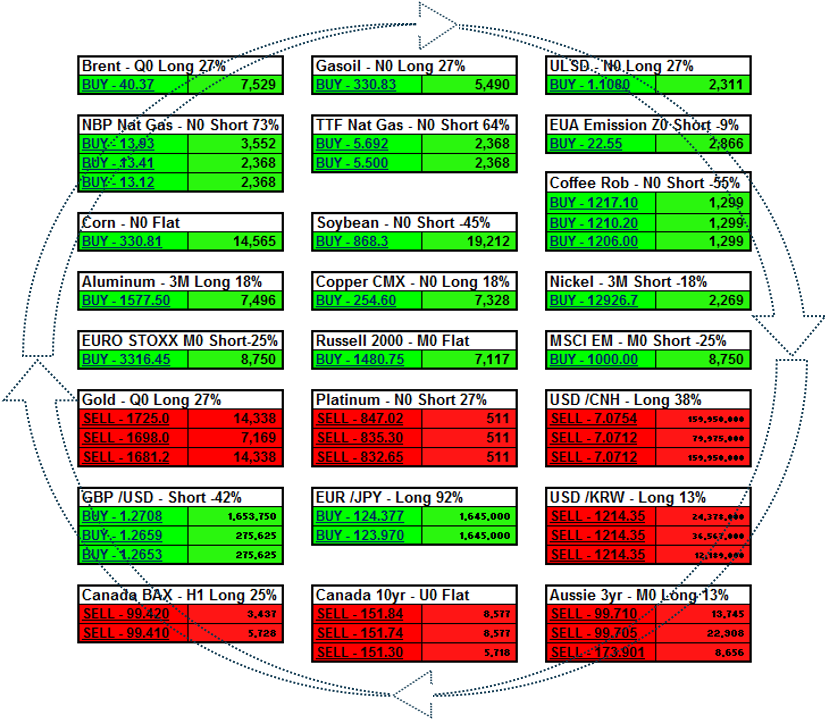

A visualization of TF Algo trade flow highlights across asset classes from last Friday can be found below.

TF Algos had been gradually Covering Short Positions in global equity indices, low-quality sovereign debt, Euro currency, petroleum and products, base metals, sugar, cotton, veg oils, oilseeds and grains during April, but continuously rising price behaviors in the first week of June triggered hundreds of buy-stops with aggressive execution styles.

Algos were also gradually Liquidating Long Positions in quality sovereign debt (US, Germany, UK and China), Gold, US Dollar (especially EM pairs) and JPY during April, but continuously sinking price behaviors in June triggered hundreds of sell-stops with aggressive execution.

As of Friday’s close, Algos had, broadly, exhausted most / not all of their nearby short-covering buy levels in equity indices, crudes and products and base metals; our latest model run did not insert many new nearby levels.

They had also, broadly, exhausted most / not all of their nearby long liquidation sell levels in USD pairs; our latest model run did not insert many new nearby levels.

From a macro perspective, the interim exhaustion of large volume directional Algo buy-stops and sell-stops may, broadly, result in reduced volatility.

Our watch list for potential TF Algo trade flows tonight and tomorrow includes:

Buy Levels in NBP nat gas, TTF nat gas, API2 Coal, Newcastle Coal, Soybean, Soymeal, Wheat, Corn, Robusta Coffee, Nasdaq, Hang Seng, ASX SPI, short and long BTP, NZ Bills, EUR/JPY, AUD/USD, AUD/JYP and GBP/USD

And Sell Levels in Gold, Live Cattle, US 5yr, Gilt, OAT, Aussie Bills, Euroyen and USD/CNH

Kindly refer to our separate TradeFlow Radar reports for details.