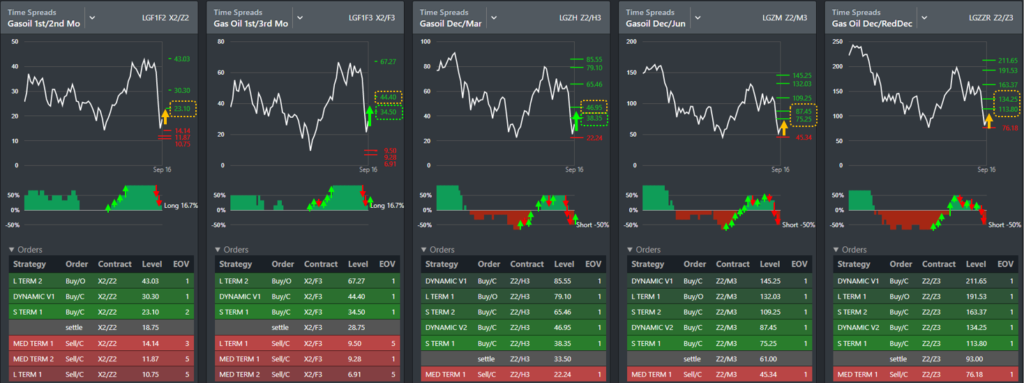

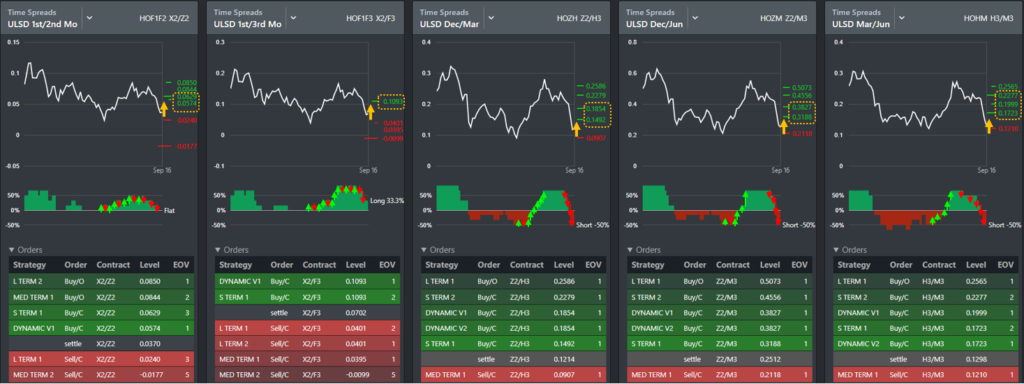

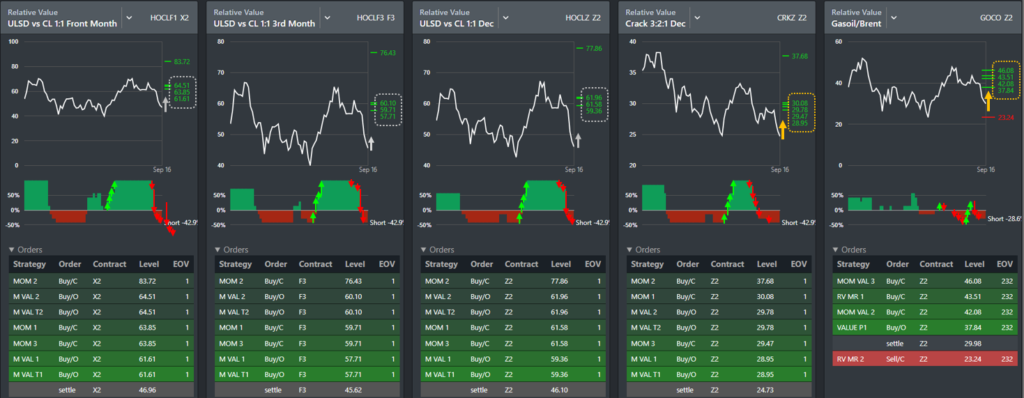

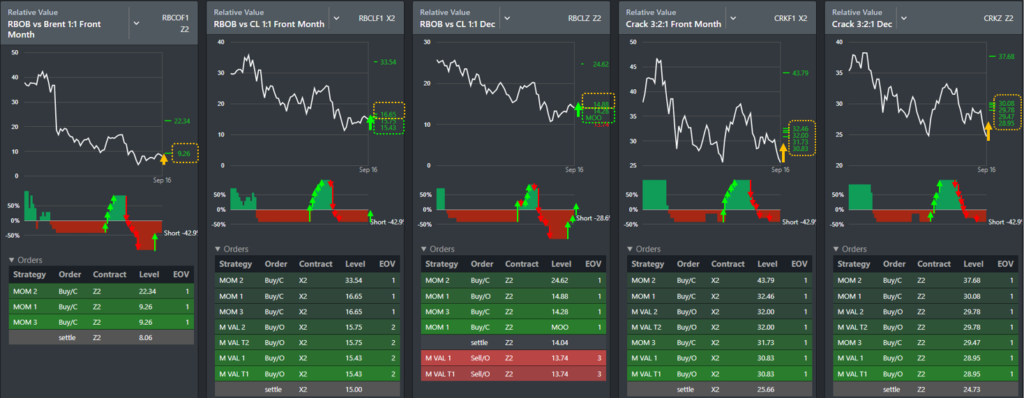

Further to the recent string of reports (at bottom), the below annotated images from our portal display today’s triggered signals, alerts for nearby signals, and daily position tracking and flows.

For the latest signal ladders and position tracking in all commodities, currencies, rates, debts, and equities (post-settlement runs), please refer to tonight’s portal, data api, and report updates.

In our September 2nd Algo Flows and Alerts report (at bottom) we wrote:

Highlighting historically recurring price dynamics influenced by algorithms:

Collective, directionally-aligned, asymmetric trade flows in one or two associated markets, originating from multiple algo strats across inter-related trade expressions (flat-prices, time spreads, and RVs) can exaggerate price-path deviations in each expression. These deviations can extend beyond economic fair values – when algo flows exhaust it can allow prices to correct, market regime depending.

Example Distillates: first 3 weeks August, algos were buyers of ULSD and Gasoil cracks, flat-prices, and time spreads. These flows incrementally pushed prices higher in each expression, and algos ‘exhausted’ their buying agendas last week (note ULSD-WTI V2 printed $74.50 last Thurs!). Since then algos were big sellers of ULSD and Gasoil flat-prices and a few time spread pairs.

Alert: the ‘absence’ of algo buying may allow prices to continue correcting and collide with concentrations of time spread and crack sell-stops nearby.

Since that post, ULSD and Gasoil prices did continue correcting lower and did collide with concentrations of time spread and crack and flat-price algo sell-stops, which may have contributed to pressing prices below economic fair values in the wake of China’s quota developments.

Alert: now, there are concentrations of time spread algo buy-stops within near-proximity in multiple pairs along the curves of ULSD and Gasoil. Today, stops triggered in Gasoil X2/F3 and Z2/H3.

Alert: now, there are buy-stops nearby in Gasoil-Brent cracks. ULSD-WTI crack buy-stops are still about $10 above, but the signals will move lower if cracks steadily strengthen.

On September 2nd we also wrote:

Example Gasoline: late August, algos were sellers of RBOB-Brent and RBOB-WTI cracks, and RBOB-ULSD, and RBOB flat-prices and RBOB time spreads. These flows incrementally pressured prices lower in each expression, according to our research, and algos have now exhausted their selling agendas (note RBOB-Brent X2 printed $3.07 yesterday!)

Alert: the ‘absence’ of algo selling may allow prices to correct and collide with concentrations of time spread and crack buy-stops sitting above.

Since then, RBOB cracks did correct higher and did collide with algo buy-stops; flat-prices and time spreads have chopped sideways without triggering any buy-stops.

Alert: today, buy signals triggered in RBOB-WTI cracks and it appears as though they did not executed their full volumes, it’s anticipated that there will be residual execution continuing into tomorrow. More buy signals are nearby in RBOB-WTI, RBOB-Brent and RBOB-ULSD-WTI 321 cracks.