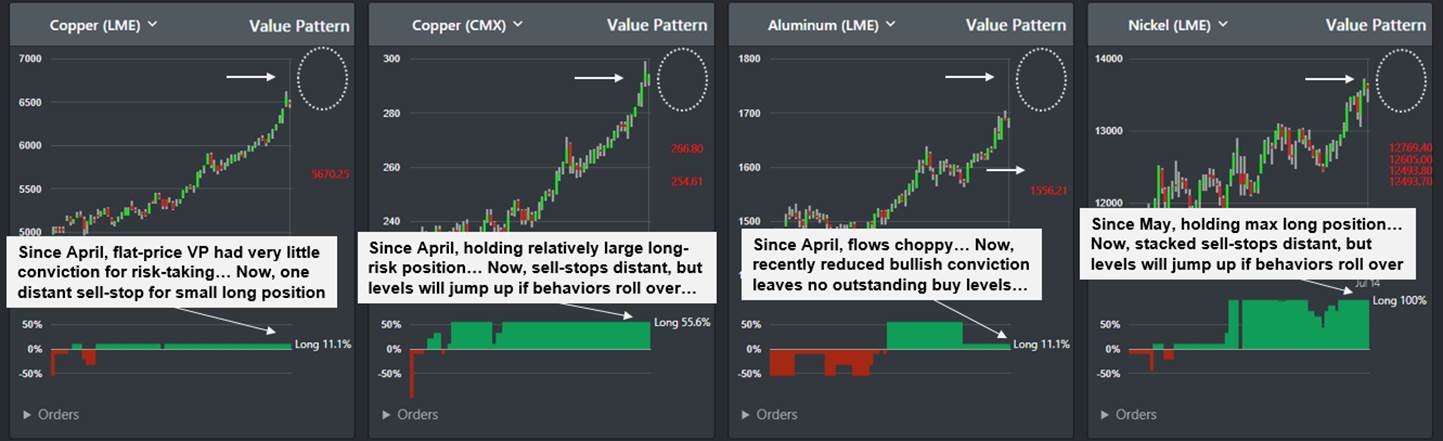

Per our report on Monday (copied below) flat-price algos, across disparate styles, exhausted their buying in Copper, Zinc and Silver.

They have almost exhausted outstanding buy levels in Aluminum, Nickel and Lead. Last week they establish max long positions in Iron Ore, HRC and Rebar.

Monday’s feature was the nearly-synchronized, large volume buying across LME, CMX and SHF Copper markets that exhausted ‘approximately 100%’ of TF maximum deployable long risk.

We noted that, historically, similar circumstances are often followed by flat-price corrections, which often ripple into time spreads, implied volatility levels and relative value spreads.

The absence of incremental flat-price algo buying can be just as influential on price paths as the presence of algo buying.

Today there was also Copper selling by fringe algo strategies, such as statistical arbitrage (note Copper and SP500 decoupled) and acceleration models (oversold tail to overbought tail).

Our models anticipate that Copper will continue to correct, in the absence of fresh bullish fundamental factors.

Screen-shot excerpts from today’s TradeFlow Radar v3 Web Portal can be found below, along with annotations.

This is a beta version; formatting and functionality are now being tuned for the production version.

Please refer to our separate nightly TradeFlow Radar v2 reports for more details across all commodities, currencies, short rates, sovereign debts and equities.